The Fed is prepared to cut interest rates for the first time in a decade

For the first time since the start of the recession more than a decade ago, the Federal Reserve is poised to cut interest rates in hopes of shielding the 11-year economic expansion from growing global uncertainties.

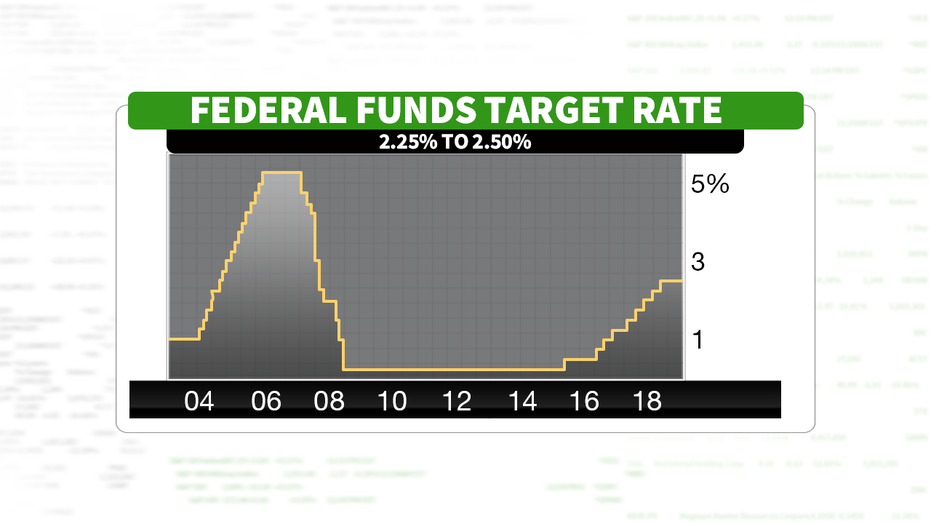

The gradual decrease in the benchmark federal funds rate — economists anticipate the U.S. central bank to lower it by a modest quarter of a percentage point — will end an era of monetary tightening by policymakers, who have voted nine times since 2015 to raise interest rates, as recently as December.

“The next question is going to be will there be any further cuts after this?” said Josh Wright, the chief economist at iCIMS and a former Fed staffer. “I think certainly these numbers will make it very easy to say one and done. We feel good about it now, and now we need to let this one cut seep through, so you’re going to let that feed through, barring any major developments.”

The expected cut will likely placate President Trump, who frequently belittles the Fed, and its chairman, Jerome Powell, for raising interest rates too high, too quickly. On Tuesday, ahead of the Federal Open Market Committee’s two-day meeting, Trump reiterated his criticisms, calling on the Fed to make a “large” rate cut.

“I would like to see a large cut, and I would like to see immediately the quantitative tightening stop,” he told reporters outside of the White House.

But it’s a fairly remarkable shift for what’s typically considered to be a slow-moving regulatory body, reversing years of slow-but-steady tightening. The Fed has not reduced interest rates since 2008, when it essentially dropped rates to zero to cope with the fallout from the financial crisis. At the time, the GDP was at -0.1 percent, and unemployment was at 6 percent.

In the second quarter of 2019, the country expanded by a 2.1 percent annual rate -- a healthy number, albeit slower than the past few years. Unemployment remains historically low at 3.7 percent.

There are some persistent “unusual uncertainties” looming on the horizon, however, Wright said, including the year-long U.S.-China trade war, concerns about softening growth in China and Brexit.

The interbank lending rate, which is currently set to a range between 2.25 percent and 2.50 percent, can affect consumers by lowering, or increasing, borrowing costs; that includes auto loan rates and 30-year-fixed mortgage rates. Even a slightly lower rate for both can save consumers thousands of dollars.

Although the lending rate is the highest level in years, it's low by historical standards. But Fed officials say it's better to cut rates now to prevent a recession than to wait for an economic slowdown.

The central bank will announce its decision on interest rates Wednesday at 2 p.m. ET.